29 April 2024

Q1 2024 equity release market data

Drawdown in vogue as equity release market ‘maintains holding pattern’ in Q1

- 14,216 new and returning customers made use of equity release products between January and March, up 4% from Q4 2023 (13,651).

- Returning customers drove a 6% quarterly increase in drawdown activity as confidence held firm amongst those with existing plans.

- 56% of new customers opted for drawdown lifetime mortgages, the highest quarterly share since the Bank of England began to increase the base rate from 0.1% in Q4 2021.

- New customer numbers dipped 11% on Q4 2023 and when coupled with the shift towards drawdown, resulted in total lending of £504m for Q1, down 6% from £535m in Q4 2023.

David Burrowes, Chair of the Equity Release Council, comments:

“The Q1 2024 data highlights the ongoing challenges facing the residential property market in the UK as the nation waits to see what happens next with interest rates and the health of the economy.

“In our market, consumer confidence is holding up well among people with existing plans, who are not shy of making use of drawdown facilities or exploring further advances. New customer numbers are lower than last year with feedback from the market suggesting that older homeowners are adopting a more cautious approach to borrowing as there are hopes of interest rate reductions in the near future.

“The flexibilities offered by modern lending products are becoming increasingly popular as customers use them to manage their borrowing in a way that best meets their individual circumstances. New customers are choosing drawdown plans with smaller initial advances while existing customers are being more modest about their borrowing compared to the start of last year.

“As we look to the rest of 2024, we are confident that the green shoots that we are starting to see will germinate and the market will return to growth. Structural drivers of the later life lending sector are only due to intensify over the coming years and Council members are ready to support clients as they make sustainable long-term choices about their finances.”

Overall activity

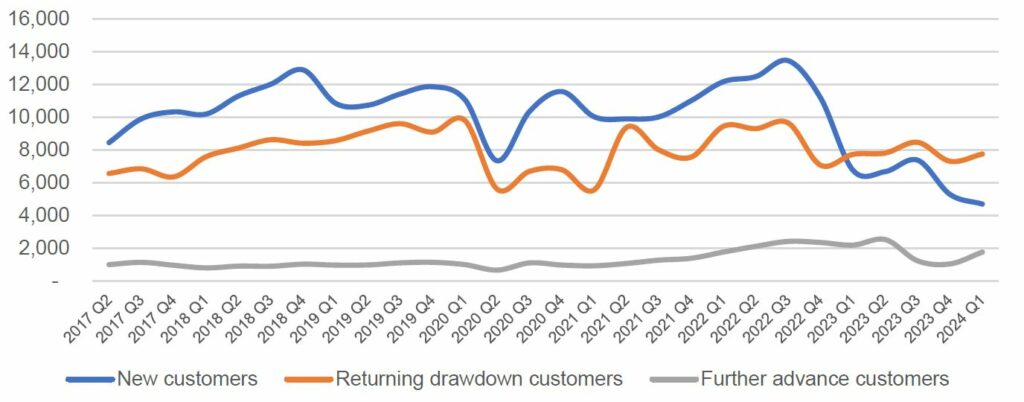

- Of the 14,216 customers who were active in the equity release market between January and March 2024, 55% were drawdown customers taking withdrawals from existing plans. One in three active customers took out new plans (33%) while the remaining 12% agreed further advances (extensions) on existing plans. [see Graph 1]

- Total quarterly lending of £504m remained subdued due to the dip in new customers and the growing preference for drawdown products, where customers hold a significant chunk of their loans in reserve for future use.

Trends among new customers

- New customer numbers (4,698) were 11% lower in Q1 than in Q4 2023 and 31% lower than in Q1 2023. With rumours of an interest rate cut ahead of summer, potential new customers are adopting a ‘wait and see attitude’ unless they have a pressing need for the funds.

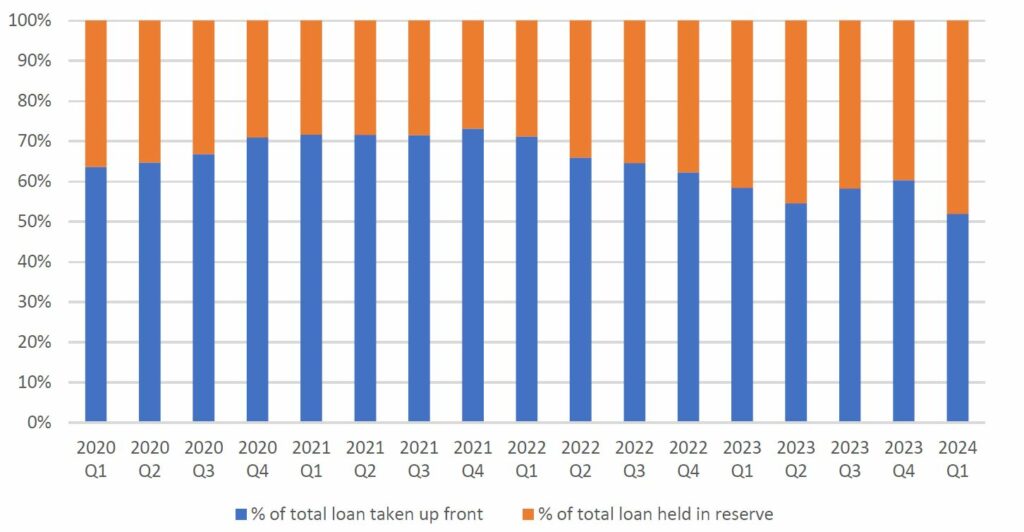

- Drawdown lifetime mortgages recorded their highest share of new customer activity in Q1 for more than two years. While 45% of new customers opted for drawdown in Q2 2022, 56% made that choice in Q1 2024.

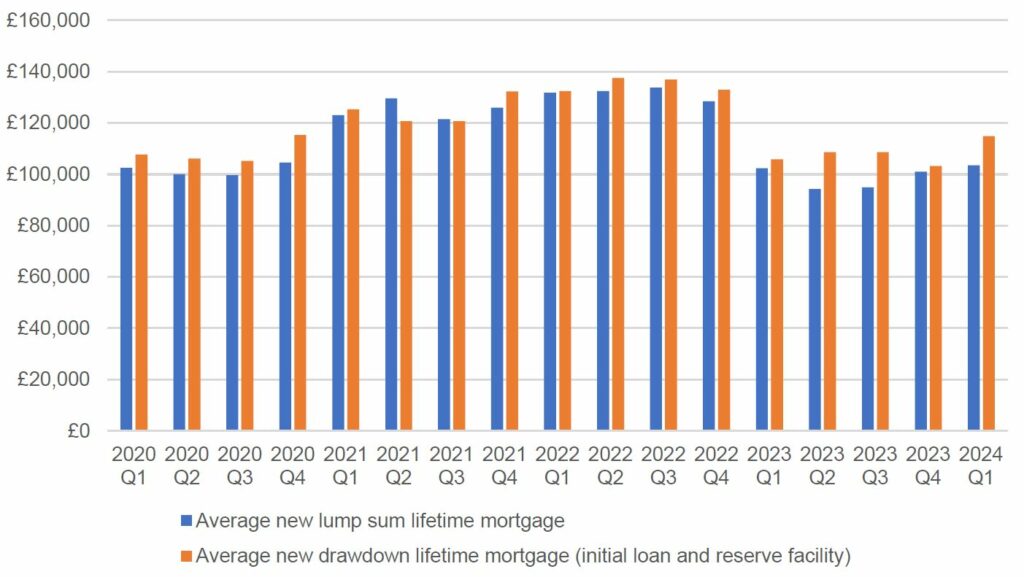

- New drawdown customers typically agree larger loans than lump sum customers, averaging £114,911 vs. £103,492 in Q1. However, with only £59,660 taken upfront, flexible product design makes it possible to benefit from future rate cuts by holding the remainder back for future needs, with each withdrawal charged at the prevailing rate at the time. [see Graph 2]

- Q1 2024 saw new drawdown customers minimising the impact of higher interest rates by reducing the first instalments of their loans by 4% to £59,660, compared with £62,198 in Q4 2023, and increasing their reserved facility by 35% to £55,251 from £40,962 in Q4.

- New drawdown customers are now taking just 52% of their loans upfront with the rest held in reserve. This compares to a 66% average being taken upfront from 2017-2022. [see Graph 3]

Trends among returning customers

- The number of returning drawdown customers taking instalments from their reserve facility reached 7,753 in Q1 2024, an increase of 6% on Q4 2023 (7,314).

- Each returning drawdown customer took £12,822 on average, up by 9% from £11,782 in Q4 but still 4% lower than was the case a year earlier in Q1 2023 (£13,345).

- In line with Equity Release Council standards, the interest rate is fixed or capped for each new instalment at the point of withdrawal, protecting customers’ borrowing from any future rate rises.

- With 1,765 further advances agreed in Q1, existing customers remain confident in seeking extensions on their plans, helped by the long-term growth of property prices leaving them with more equity to withdraw within the careful loan-to-value limits set by providers.

Market data

Graph 1: Equity release customer numbers per quarter by customer type

Graph 2: Average new loan sizes among equity release customers

Graph 3: Breakdown of new drawdown lifetime mortgages between initial loan and reserves

About the data

The Equity Release Council’s market statistics are compiled from member activity, which includes all national providers in the equity release market. This latest edition was produced in April 2024 using data from customer activity during the first quarter of the year (January to March). All figures quoted are aggregated for the whole market and do not represent the business of individual member firms.

Equity release products are available to homeowners aged 55+, enabling them to release money from the value of their home following a regulated process of financial advice and independent legal advice to determine whether this is suitable for their individual circumstances and long-term needs. Funds released are typically used for a range of purposes including providing additional retirement income, funding one-off expenses and lifestyle purchases, consolidating debts, meeting homecare costs and gifting a ‘living inheritance’ to family or friends.

For a comprehensive list of members, please visit the Council’s online member directory.

About the Equity Release Council

The Equity Release Council is the representative trade body for the UK equity release sector with more than 750 member firms and 1,900 individuals registered, including providers, funders, regulated financial advisers, solicitors, surveyors and other professionals.

It leads a consumer-focused UK based equity release market by setting authoritative standards and safeguards for the trusted provision of advice and products. Since 1991, more than 650,000 homeowners have accessed £46bn of property wealth via Council members to support their finances.

The Council also works with government, voluntary and public sectors, and regulatory, consumer and professional bodies to inform and influence debate about the use of housing wealth in later life and retirement planning.

For more information:

Visit www.equityreleasecouncil.com

Email Instinctif Partners at [email protected]

Phone Andy Lane and Libby Wallis on +44 (0) 207 457 2020