17 May 2024

No brick left unturned: three in five UK homeowners look to property wealth to prop up retirement dream

To visit the Home Advantage hub and read more reports from the study click here

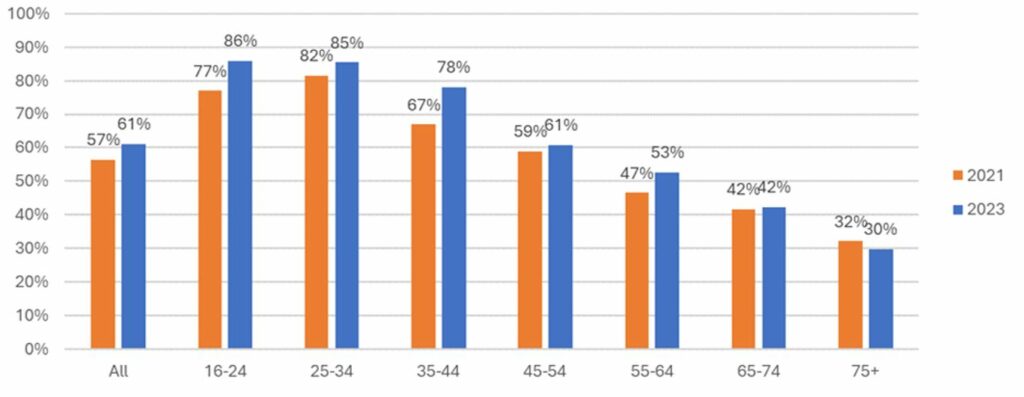

- More than three in five (61%) UK homeowners are interested in releasing money from their property in later life to meet various financial needs, up from 57% in 2021

- Homeowners increasingly believe it is becoming more common (39%) and acceptable (39%) to have a mortgage in later life, both up from 34% in 2021

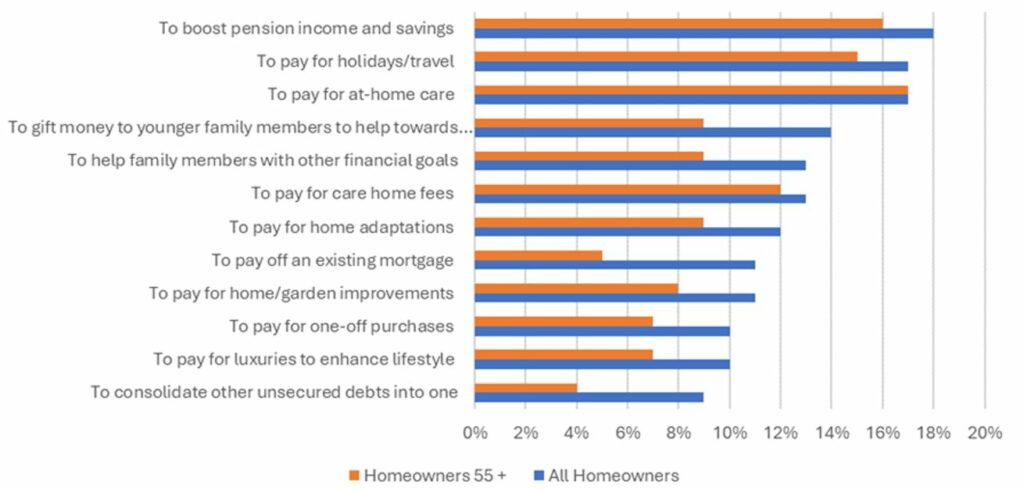

- The biggest drivers for doing so are to meet care-related costs (17%) and boosting pension income (16%)

More than three in five (61%) UK homeowners – equivalent to 18.7 million people* – are interested in releasing money from their home in later life to meet a range of financial needs, according to new findings from the Equity Release Council (the Council).

This figure has risen since 2021, when 57% of people said the same. The trend is revealed by the Council’s Home Advantage study of 5,000 UK adults’ financial attitudes and experiences, supported by Equity Release Supermarket.

Growing Acceptance of Borrowing into Older Age:

The research shows the increasingly important role of property to help fund a comfortable retirement. With more ‘ultra-long mortgages’ running beyond people’s state pension age, only 26% of homeowners rule out the idea of accessing money from their homes when they are older.

Almost two in five believe it is becoming more common (39%) and acceptable (39%) to have a mortgage in later life. Both measures have increased from 34% since 2021.

Almost half (46%) of homeowners aged 55 and over now see property wealth as a means of satisfying later life needs. Even stronger appetite exists among younger homeowners. Three in four (75%) below the age of 55 are open to leaning on their property wealth in later life.

The biggest shift in attitudes since 2021 has been among the 35-44 group, with 78% interested in accessing money from the value of their home in future, up from 67%.

Graph 1: Percentage of homeowners interested in unlocking property wealth in later life

Meeting Care and Retirement Costs a Key Focus for Borrowers:

Among homeowners aged 55 – the age where homeowners can access property wealth via equity release products – key motivations for releasing money from their homes include the desire to pay for care at home (17%), boost their retirement income (16%), or to fund travel plans (15%).

Supporting the financial wellbeing of younger family members is also an important priority. Nearly one in seven (14%) are interested in ‘giving while living’ by gifting money from their property wealth to family for a deposit towards their first home, with 13% looking to gift money to younger family to support other financial goals.

Graph 2: Most popular future financial priorities when accessing property wealth

With annual residential care costs now approaching £46,000 in major UK cities and many older people reluctant to go into a care home, separate research from Care UK** demonstrates that equity release is already one of the most popular methods to pay for at home care.

Jim Boyd, CEO of the Equity Release Council, comments:

“In an ideal world, most people would retire with a mortgage-free home and a substantial pension but that is not the reality of modern Britain. People are choosing products such as ultra long mortgages out of necessity as the lower repayments allow them to purchase a home, save into their pensions and finance their day-to-day living expenses.

“The rise of products such as ultra long mortgages highlight the changing relationship people have with property wealth as it is increasingly being seen as an asset rather than simply bricks and mortar. Almost half of over-55s see property wealth as a means to meeting later life needs and the younger generation is even more wedded to this approach.

“We need to support people look at all their options when it comes to funding retirement whether it is pensions, property or investments. One size does not fit all. Encouraging people to have realistic conversations will provide more people with the type of retirement they want and need.”

Mark Gregory, Founder and CEO of Equity Release Supermarket, comments:

“Many factors dictate why people opt for equity release and changes in consumer behaviour tend to be reflective of the current market competitiveness. At one time people thought their mortgages would run just for the mandated term, but changing attitudes and acceptance towards borrowing into retirement has created ongoing demand for these types of products.

“This coupled with a decline in pension provisions, savings and longer life expectancy has given rise to a need to borrow in later life as people look to redistribute their wealth to the younger generation, pay for care, replace their mortgage, or fund lifestyle goals.

“The equity release sector has significantly evolved in line with these consumer demands and now encompasses far greater opportunities around later life living and finance. The beauty of the market today is that there are tools and platforms that exist, which help consumers to navigate these choices, enable them to review all options, view real-time rates and gain whole of market advice.”

Lifetime mortgages, the most common form of equity release, are typically loans for people over 55 that are usually repaid when the customer dies or goes into long-term care.

The Equity Release Council is the representative trade body for the UK equity release sector. It sets industry standards and safeguards, such as a no negative equity guarantee and the right to penalty-free repayments, enabling customers to manage their loans.

ENDS

Notes to Editors

All findings come from independent research carried out by Censuswide among 5,000 nationally representative UK adults aged 18+ in June 2021 and November 2023. Combined with analysis of government, regulatory and industry data, Home Advantage represents the Council’s biggest study to date of consumer attitudes and behaviours in relation to their personal finances and property wealth. The 2023 edition of the research is supported by Equity Release Supermarket, as well as Canada Life.

*Population data published by the ONS reveals that there are 55,190,347 adults aged 16+ in the UK. Our survey found that 55.63% are homeowners (30,702,390) and 61% of homeowners are interested in unlocking property wealth which equates to 18,728,458 (18.7m). https://www.ons.gov.uk/peoplepopulationandcommunity/populationandmigration/populationestimates/datasets/populationestimatesforukenglandandwalesscotlandandnorthernireland

**https://ukcareguide.co.uk/equity-release-advice-index/

For media enquiries, please contact:

Instinctif Partners at [email protected]

Phone Georgia Turton, Isaac Seiger and Libby Wallis on +44 (0) 207 457 2020

About the Equity Release Council

The Equity Release Council (the Council) is the representative trade body for the UK equity release sector with more than 750 member firms and 1,800 individuals registered, including providers, funders, regulated financial advisers, solicitors, surveyors and other professionals.

It leads a consumer-focused UK based equity release market by setting authoritative standards and safeguards for the trusted provision of advice and products. Since 1991, more than 650,000 homeowners have accessed £46bn of property wealth via Council members to support their finances.

The Council also works with government, voluntary and public sectors, and regulatory, consumer and professional bodies to inform and influence debate about the use of housing wealth in later life and retirement planning.

For more information:

Visit www.equityreleasecouncil.com

About Equity Release Supermarket:

Equity Release Supermarket was founded by Mark Gregory in 2008, and has grown to become the UK’s No.1 independent equity release advisory service, having helped thousands of people to enjoy financial freedom through equity release. They’ve built their reputation on the premise of outstanding financial advice.

Mark was an equity release adviser and so he understands both the customer journey and how equity release can help change people’s lives. His vision was one where he could offer his customers the very best impartial financial advice, access plans from the whole marketplace, recommend the best equity release deals, and make the most of technology to help his customers.

Equity Release Supermarket have a 100% Trusted Merchant Status from independent review service Feefo and are regulated directly by the Financial Conduct Authority (FCA) No. 584063. They are also members of the Equity Release Council, who set the standards for the industry.

For more information, please visit: https://www.equityreleasesupermarket.com

For more information about smartER, please visit: https://www.equityreleasesupermarket.com/smarter-equity-release-search